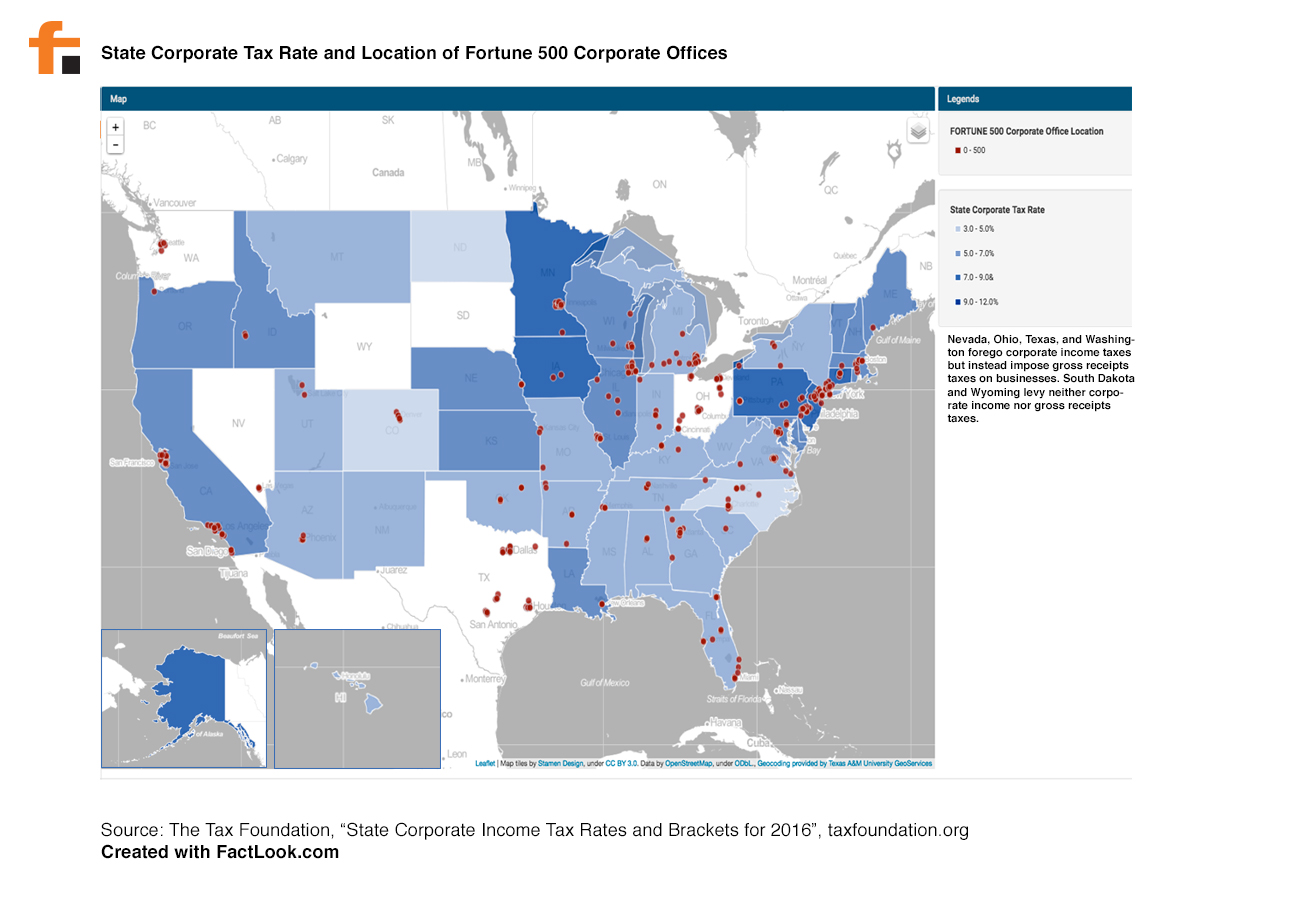

The Tax Foundation provides state corporate income tax rate data for the 44 states that levy corporate income taxes. Four states (Nevada, Ohio, Texas and Washington) impose gross receipts instead of corporate income taxes. South Dakota and Wyoming are the only states that do not levy a corporate income or gross receipts tax.

We were interested in seeing this tax information in relationship to the location of the corporate offices of companies on the Fortune 500 list. We found the latitude/longitude coordinates for the HQ’s in a dataset maintained by the Department of Homeland Security. Here’s a quick breakdown of the number of Fortune 500 companies located in the states with the highest corporate tax rate:

| State | # of 500’s | Corp. Tax Rate (%) |

| Iowa | 2 | 12.0 |

| Pennsylvania | 27 | 9.99 |

| Minnesota | 19 | 9.80 |

| New Jersey | 24 | 9.0 |

| Connecticut | 12 | 9.0 |

BTW, the states with the highest number of Fortune 500 corporations are:

| State | # of 500’s |

| Texas | 56 |

| New York | 53 |

| California | 52 |